Windfall Drilling at Gold Bar Mine Complex Intersects Significant Mineralization: 2.4 GPT Oxide Gold Over 74.7 Meters & 6.1 GPT High-Grade Gold Over 6.1 Meters

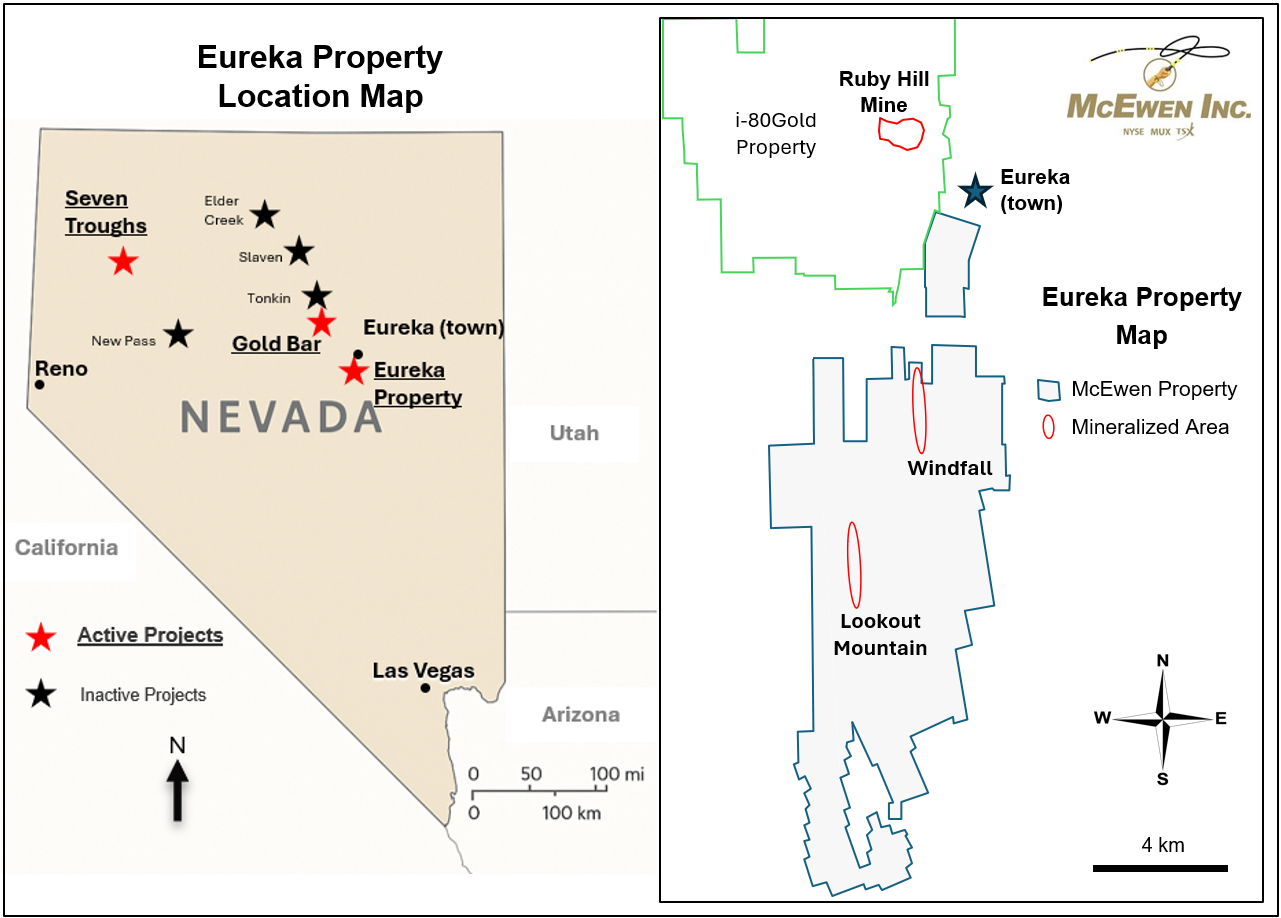

TORONTO, Oct. 22, 2025 (GLOBE NEWSWIRE) -- McEwen Inc. (NYSE/TSX: MUX) (“McEwen” or the “Company”) is pleased to report encouraging new results from its 2025 drilling program at Windfall, part of the Company’s Gold Bar Mine Complex, in the Eureka Mining District of Nevada. The drilling program at Windfall represents one of several initiatives currently underway by the Company to: 1) increase gold resources, 2) extend mine life and 3) lower production costs at the Gold Bar Mine.

Windfall was acquired by McEwen as part of the Timberline Resources purchase in 2024. At the time of acquisition, Timberline had published a resource estimate for the Eureka Property (Timberline Resources S-K 1300 report, 2023), which contained:

- 423,000 ounces gold in the Measured and Indicated categories, from 23,423,000 tonnes grading 0.56 grams per tonne (gpt) gold (Au), or 25,819,000 tons grading 0.017 ounces per ton (oz/T) Au; and

- 84,000 ounces gold in the Inferred category, from 6,641,000 tonnes grading 0.39 gpt Au, or 7,322,000 tons grading 0.011 oz/T Au.

Incorporating the 2024-2025 Windfall drill results into the estimate is expected to have a positive impact on the resource size.

It has been the Company’s view that there is an opportunity to meaningfully increase the gold resources and incorporate them into the plan for the Gold Bar Mine (now referred to as the Gold Bar Mine Complex), where the average grade mined during the first half of 2025 was 0.76 gpt (0.022 oz/T) Au. The latest drilling results continue to validate this view. Notably, the Windfall area, which was not included in the previous resource estimate, continues to build on its earlier encouraging results.

New Key Results From Windfall Drilling

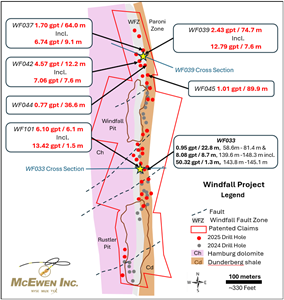

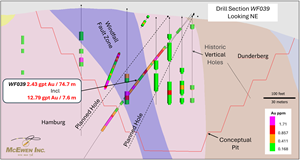

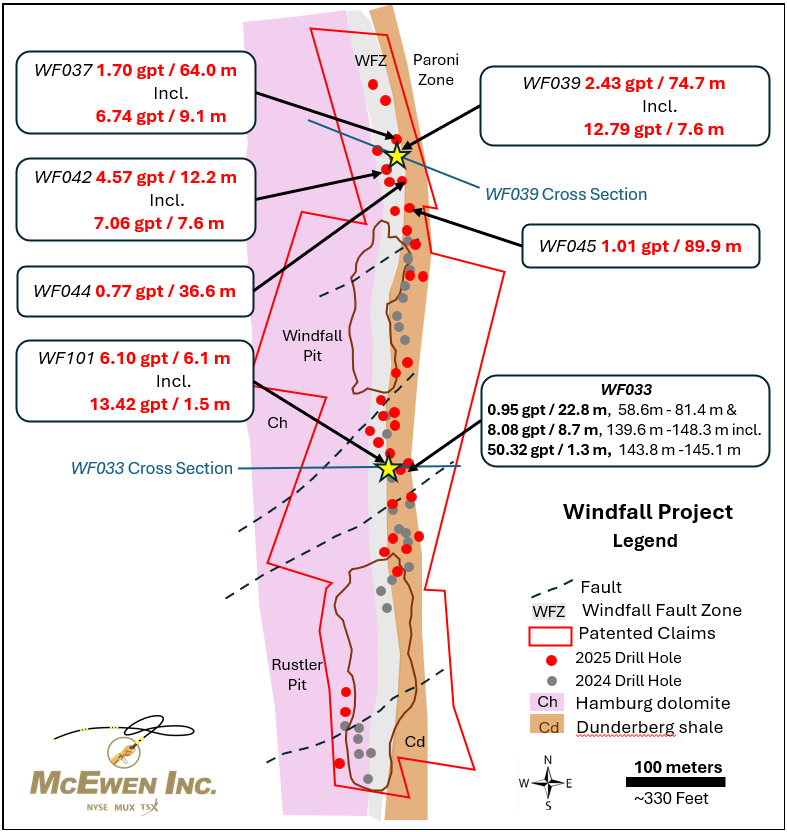

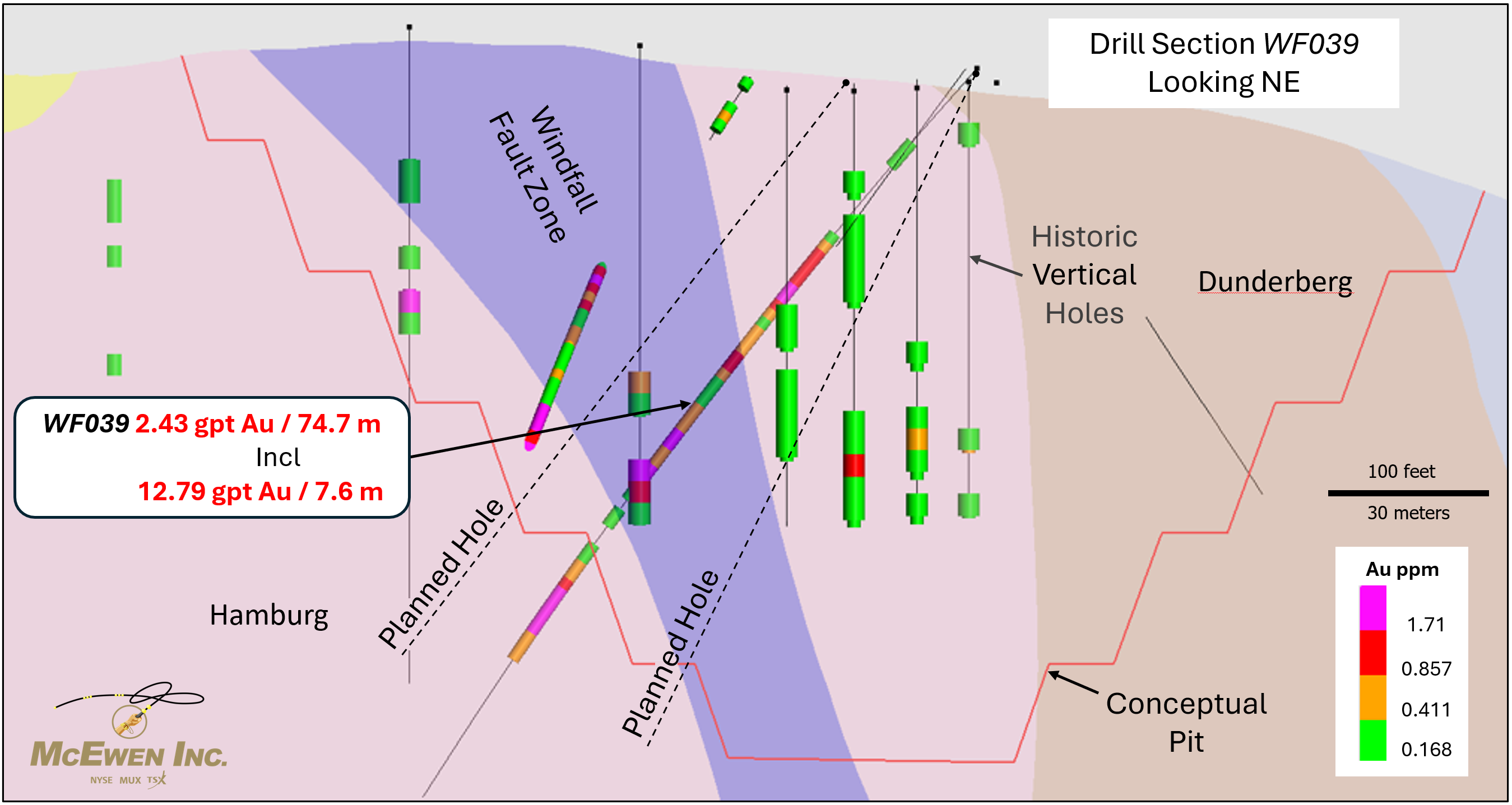

- Drill hole WF039 intersected new near-surface oxide mineralization (Figures 2 & 3):

- 2.43 gpt gold over 74.7 meters, including

- 12.79 gpt gold over 7.6 meters

- Other strong near-surface oxide results include (Figure 2):

- 4.57 gpt gold over 12.2 meters (drill hole WF042)

- 1.70 gpt gold over 64.0 meters (drill hole WF037)

- 1.01 gpt gold over 89.9 meters (drill hole WF045)

- 0.77 gpt gold over 36.6 meters (drill hole WF044)

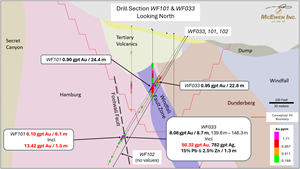

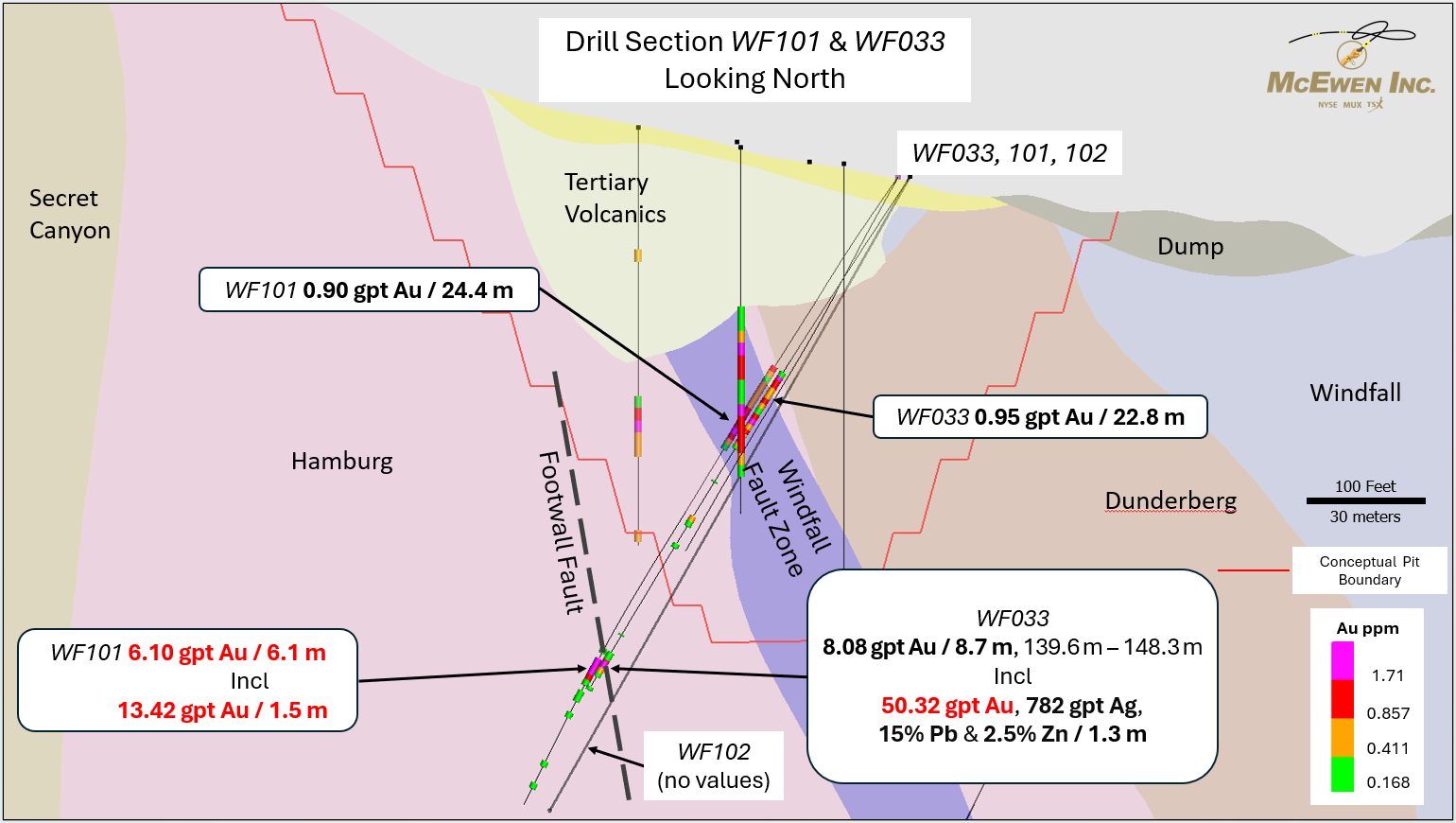

- New deeper high-grade zone continues to emerge (Figures 2 & 4):

- 6.10 gpt gold over 6.1 meters, including 13.42 gpt gold over 1.5 meters (drill hole WF101)

This result in drill hole WF101, with base metal results pending, follows up with a 7.5 meters offset on drill hole WF033, which returned 8.08 gpt gold over 8.7 meters, including 50.32 gpt gold, 782 g/t silver, 15% lead, 2.5% zinc, i.e. 62.47 g/t gold equivalent, over 1.3 meters (see press release dated September 3, 2025). Our interpretation is that this mineralization is controlled by the intersection of multiple faults. Other holes in this target area have been completed, with assays pending.

The near surface results demonstrate the continuity of oxide gold mineralization along a 1.6-kilometer-long (1 mile) section of the north-south-trending Windfall fault zone (Figure 2). The gold mineralization at Windfall remains open for further expansion in multiple directions.

Why It Should Matter to Our Shareholders & the Value of Our Company

- This newly discovered gold mineralization is beyond the limits of the previous resource estimate. The gold mineralization remains open for further expansion, with very encouraging grades and thicknesses.

- The gold mineralization is near-surface and oxidized, which means it could be potentially processed by heap leach recovery, the same process being used at the Gold Bar Mine.

- Windfall is located on private land, potentially allowing for faster production permitting.

Drilling Priorities for the Remainder of 2025

- Continue resource-definition and expansion drilling in the Windfall area.

- Test lateral and depth extensions of higher-grade zones.

-

Work on publishing an updated resource estimate.

About McEwen

McEwen shares trade on both the NYSE and TSX under the ticker MUX.

McEwen provides its shareholders with exposure to a growing base of gold and silver production in addition to a very large copper development project, all in the Americas. The gold and silver mines are in prolific mineral-rich regions of the world, the Cortez Trend in Nevada, USA, the Timmins district of Ontario, Canada and the Deseado Massif in Santa Cruz province, Argentina. McEwen is also considering reactivating a gold and silver mine in Mexico.

The Company has a 46.4% interest in McEwen Copper, which owns the large, long-life, advanced-stage Los Azules copper development project in San Juan province, Argentina – a region that hosts some of the country’s largest copper deposits. According to the last financing for McEwen Copper, the implied value of McEwen’s ownership interest is US$456 million.

The Los Azules copper project is designed to be one of the world’s first regenerative copper mines and carbon neutral by 2038. Its Feasibility Study results were announced in the press release dated October 7, 2025.

Chairman and Chief Owner Rob McEwen has invested over US$200 million personally and takes a salary of $1 per year, aligning his interests with shareholders. He is a recipient of the Order of Canada, a member of the Canadian Mining Hall of Fame and a winner of the Ernest & Young Entrepreneur of the Year (Energy) award. His objective is to build MUX’s profitability, share value and eventually implement a dividend policy, as he did while building Goldcorp Inc.

Technical Disclosure

Prepared under the supervision of Robert Kastelic, CPG, Exploration Manager in Nevada for McEwen Inc. and Qualified Person (QP) under SEC S-K 1300 and NI 43-101.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements and information, including "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements and information expressed, as at the date of this news release, McEwen Inc.'s (the "Company") estimates, forecasts, projections, expectations or beliefs as to future events and results. Forward-looking statements and information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ materially from current expectations expressed or implied by the forward-looking statements and information include, but are not limited to, fluctuations in the market price of precious metals, mining industry risks, political, economic, social and security risks associated with foreign operations, the ability of the Company to receive or receive in a timely manner permits or other approvals required in connection with operations, risks associated with the construction of mining operations and commencement of production and the projected costs thereof, risks related to litigation, the state of the capital markets, environmental risks and hazards, uncertainty as to calculation of mineral resources and reserves, foreign exchange volatility, foreign exchange controls, foreign currency risk, and other risks. Readers should not place undue reliance on forward-looking statements or information included herein, which speak only as of the date hereof. The Company undertakes no obligation to reissue or update forward-looking statements or information as a result of new information or events after the date hereof except as may be required by law. See McEwen Inc.'s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, and other filings with the Securities and Exchange Commission, under the caption "Risk Factors", for additional information on risks, uncertainties and other factors relating to the forward-looking statements and information regarding the Company. All forward-looking statements and information made in this news release are qualified by this cautionary statement.

|

The NYSE and TSX have not reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by the management of McEwen. |

| Want News Fast? Subscribe to our email list: https://www.mcewenmining.com/contact-us/#section=followUs and receive news as it happens! |

| WEB SITE | SOCIAL MEDIA | |||||

| www.mcewenmining.com |

McEwen |

Facebook: | facebook.com/mceweninc | |||

| LinkedIn: | linkedin.com/company/mceweninc | |||||

| CONTACT INFORMATION | X: | X.com/mceweninc | ||||

| 150 King Street West | Instagram: | instagram.com/mceweninc | ||||

| Suite 2800, PO Box 24 | ||||||

| Toronto, ON, Canada |

McEwenCopper |

Facebook: | facebook.com/ mcewencopper | |||

| M5H 1J9 | LinkedIn: | linkedin.com/company/mcewencopper | ||||

| X: | X.com/mcewencopper | |||||

| Relationship with Investors: | Instagram: | instagram.com/mcewencopper | ||||

| (866)-441-0690 - Toll free line | ||||||

| (647)-258-0395 |

Rob McEwen |

Facebook: | facebook.com/mcewenrob | |||

| Mihaela Iancu ext. 320 | LinkedIn: | linkedin.com/in/robert-mcewen-646ab24 | ||||

| info@mcewenmining.com | X: | X.com/robmcewenmux | ||||

Appendix – Technical Information

The information in this appendix is provided for technical readers and analysts.

Assay Highlights

- WF039: 2.43 gpt (0.071 oz/T) gold over 74.7 m (245 ft) from 30.5 m (100 ft).

- WF042: 4.57 gpt (0.13 oz/T) gold over 12.2 m (40 ft) from 54.9 m (180 ft).

- WF037: 1.70 gpt (0.05 oz/T) gold over 64 m (210 ft) from 41.1 m (135 ft).

- WF045: 1.01 gpt (0.03 oz/T) gold over 89.9 m (295 ft) from 89.9 m (295 ft).

- WF044: 0.77 gpt (0.02 oz/T) gold over 36.6 m (120 ft) from 88.4 m (290 ft).

- WF101: 6.10 gpt (0.178 oz/T) gold over 6.1 m (20 ft) from 141.7 m (465 ft).

Geological Setting

- Gold mineralization in the Paroni Zone, north of the Windfall Pit (Figure 2), is hosted in the Windfall Fault Zone within silicified and decalcified breccia in dolomite of the Hamburg Formation.

- New drilling demonstrates significant lateral and vertical extension of mineralization.

- Thicker and higher-grade zones located at intersections of Windfall Fault Zone with northeast-trending cross faults.

Metallurgical & Permitting Notes

- Oxidized gold mineralization demonstrated strong cyanide recovery (CN ratios above 60% are considered favorable for heap leach processing).

- The Windfall area sits on patented claims, which could reduce permitting timelines.

Table 1: Selection of assay results from the 2025 drilling program at the Windfall Project

| Drill Hole |

From (m) |

To (m) |

Length (m) |

Au (gpt) |

From (ft) |

To (ft) |

Length (ft) |

Au (oz/T) |

CN Ratio % |

|

| WF034 | 44.2 | 64.0 | 19.8 | 0.72 | 145 | 210 | 65.0 | 0.021 | 86.0 | % |

| incl | 51.8 | 59.4 | 7.6 | 1.17 | 170 | 195 | 25.0 | 0.034 | 80.2 | % |

| WF039 | 13.7 | 18.3 | 4.6 | 0.26 | 45 | 60 | 15.0 | 0.008 | 67.7 | % |

| and | 30.5 | 105.2 | 74.7 | 2.43 | 100 | 345 | 245.0 | 0.071 | 85.2 | % |

| incl | 93.0 | 100.6 | 7.6 | 12.79 | 305 | 330 | 25.0 | 0.374 | 75.9 | % |

| WF041 | 74.7 | 86.9 | 12.2 | 1.27 | 245 | 285 | 40.0 | 0.037 | ||

| incl | 79.2 | 83.8 | 4.6 | 2.71 | 260 | 275 | 15.0 | 0.079 | ||

| WF036 | 32.0 | 93.0 | 61.0 | 0.52 | 105 | 305 | 200.0 | 0.015 | 88.0 | % |

| incl | 65.5 | 71.6 | 6.1 | 1.72 | 215 | 235 | 20.0 | 0.050 | 68.4 | % |

| WF037 | 41.1 | 105.2 | 64.0 | 1.70 | 135 | 345 | 210.0 | 0.050 | 84.0 | % |

| incl | 85.3 | 94.5 | 9.1 | 6.74 | 280 | 310 | 30.0 | 0.197 | 86.7 | % |

| WF101 | 56.4 | 80.8 | 24.4 | 0.90 | 185 | 265 | 80.0 | 0.026 | 81.1 | % |

| incl | 68.6 | 71.6 | 3.0 | 1.54 | 225 | 235 | 10.0 | 0.045 | 72.3 | % |

| incl | 74.7 | 77.7 | 3.0 | 1.96 | 245 | 255 | 10.0 | 0.057 | 92.7 | % |

| and | 138.7 | 158.5 | 19.8 | 2.00 | 455 | 520 | 65.0 | 0.058 | 84.7 | % |

| incl | 141.7 | 147.8 | 6.1 | 6.10 | 465 | 485 | 20.0 | 0.178 | 80.9 | % |

| incl | 141.7 | 143.3 | 1.5 | 13.42 | 465 | 470 | 5.0 | 0.392 | 73.7 | % |

| WF043 | 41.1 | 42.7 | 1.5 | 0.21 | 135 | 140 | 5.0 | 0.006 | ||

| and | 62.5 | 70.1 | 7.6 | 1.01 | 205 | 230 | 25.0 | 0.029 | ||

| and | 73.2 | 74.7 | 1.5 | 0.24 | 240 | 245 | 5.0 | 0.01 | ||

| and | 79.2 | 82.3 | 3.0 | 0.18 | 260 | 270 | 10.0 | 0.01 | ||

| and | 86.9 | 91.4 | 4.6 | 1.17 | 285 | 300 | 15.0 | 0.03 | ||

| WF045 | 89.9 | 179.8 | 89.9 | 1.01 | 295 | 590 | 295.0 | 0.03 | 72.3 | % |

| WF046 | 42.7 | 56.4 | 13.7 | 0.50 | 140 | 185 | 45.0 | 0.01 | 87.7 | % |

| WF047 | 85.3 | 106.7 | 21.3 | 0.72 | 280 | 350 | 70.0 | 0.02 | ||

| incl | 94.5 | 102.1 | 7.6 | 1.41 | 310 | 335 | 25.0 | 0.04 | ||

| WF042 | 54.9 | 67.1 | 12.2 | 4.57 | 180 | 220 | 40.0 | 0.13 | ||

| incl | 54.9 | 62.5 | 7.6 | 7.06 | 180 | 205 | 25.0 | 0.21 | ||

| WF044 | 88.4 | 125.0 | 36.6 | 0.77 | 290 | 410 | 120.0 | 0.02 | ||

| WF048 | 153.9 | 157.0 | 3.0 | 2.93 | 505 | 515 | 10.0 | 0.09 | 84.8 | % |

| and | 192.0 | 199.6 | 7.6 | 0.24 | 630 | 655 | 25.0 | 0.01 | 75.9 | % |

| WF049 | 163.1 | 166.1 | 3.0 | 2.11 | 535 | 545 | 10.0 | 0.06 | 78.8 | % |

| and | 211.8 | 233.2 | 21.3 | 0.20 | 695 | 765 | 70.0 | 0.01 | 91.0 | % |

| WF050 | 76.2 | 89.9 | 13.7 | 0.54 | 250 | 295 | 45.0 | 0.02 | ||

| WF051 | 65.5 | 82.3 | 16.8 | 2.93 | 215 | 270 | 55.0 | 0.09 | ||

| and | 93.0 | 134.1 | 41.1 | 0.38 | 305 | 440 | 135.0 | 0.01 | ||

| WF082 | 33.5 | 39.6 | 6.1 | 0.44 | 110 | 130 | 20.0 | 0.01 | ||

| WF087 | 35.1 | 50.3 | 15.2 | 0.35 | 115 | 165 | 50.0 | 0.01 | ||

| WF035 | 37.2 | 53.2 | 16.0 | 0.39 | 122 | 174.5 | 52.5 | 0.01 | ||

| and | 90.5 | 93.8 | 3.3 | 3.03 | 297 | 307.7 | 10.7 | 0.09 | ||

| WF060 | 83.8 | 93.0 | 9.1 | 0.28 | 275 | 305 | 30.0 | 0.01 | ||

| and | 99.1 | 118.9 | 19.8 | 0.63 | 325 | 390 | 65.0 | 0.02 | ||

| WF083 | 86.9 | 100.6 | 13.7 | 0.32 | 285 | 330 | 45.0 | 0.01 | ||

| and | 195.1 | 213.4 | 18.3 | 0.38 | 640 | 700 | 60.0 | 0.01 | ||

| WF085 | no significant values | |||||||||

|

Conversions from imperial units to metric may not sum due to rounding. Drill holes without CN Ratio % values in the last column have CN assays pending. | ||||||||||

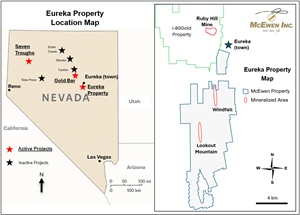

Figure 1: Map of Eureka Property showing Windfall, Lookout Mountain, and Ruby Hill Mine (i-80 Gold)

Figure 2: Map showing the location of new drill results in the Windfall area

Figure 3: Cross-section of drill hole WF039 showing the extent of new mineralization found in the Windfall Fault Zone

Figure 4: Cross-section showing mineralization of drill hole WF101 follow-up on drill hole WF033.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/0dd7e368-1d2d-4391-a691-8d9a2434322a

https://www.globenewswire.com/NewsRoom/AttachmentNg/d7d7ce9a-e0f5-48e7-9516-89d487462daf

https://www.globenewswire.com/NewsRoom/AttachmentNg/41e3d35f-ccc5-4369-8a07-ed79a8e89113

https://www.globenewswire.com/NewsRoom/AttachmentNg/f977c6e7-13f9-4ca8-bcfe-135321978df5

Figure 1: Map of Eureka Property showing Windfall, Lookout Mountain, and Ruby Hill Mine (i-80 Gold)

Figure 1: Map of Eureka Property showing Windfall, Lookout Mountain, and Ruby Hill Mine (i-80 Gold)

Figure 2: Map showing the location of new drill results in the Windfall area

Figure 2: Map showing the location of new drill results in the Windfall area

Figure 3: Cross-section of drill hole WF039 showing the extent of new mineralization found in the Windfall Fault Zone

Figure 3: Cross-section of drill hole WF039 showing the extent of new mineralization found in the Windfall Fault Zone

Figure 4: Cross-section showing mineralization of drill hole WF101 follow-up on drill hole WF033.

Figure 4: Cross-section showing mineralization of drill hole WF101 follow-up on drill hole WF033.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.